From Prohibition to $40 Billion: Cannabis Industry Statistics & Analysis

The average lifespan in the United States is 77 years, but in the rapidly evolving cannabis sector, even 28 years can feel like a lifetime. On November 5, 1996, legislators in the state of California passed the Compassionate Use Act, becoming the first state to facilitate the legal manufacturing, cultivation, production, and sale of products for medicinal use. This ratification was not only frowned upon by federal lawmakers, but members of former President Bill Clinton’s administration threatened legal action against state lawmakers supporting medical cannabis use.

“Marijuana is dangerous, it’s illegal, and it’s wrong,” stated former United States Secretary of Health and Human Services Donna Shalala.

More than 28 years later, a substance once deemed “dangerous,” “illegal,” and “wrong” is the lifeblood of a thriving legal industry spanning more than three dozen states and several countries. After experiencing great success and evolution in 2022 and 2023, the marijuana industry achieved major milestones in 2024 and remains poised for additional growth in 2025.

Pushing Past Prohibition: Analysis of Political and Social Perceptions of Cannabis in the United States

Political Perception: Cannabis Comes to Capitol Hill

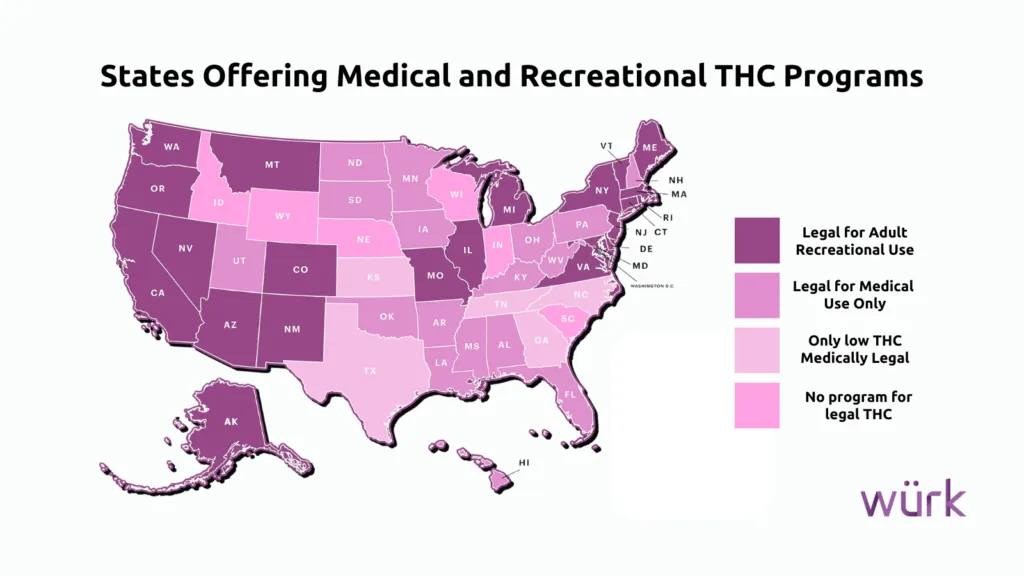

Nearly 30 years after former secretary Donna Shalala depicted cannabis as a detriment to public health, 40 states and the District of Columbia have launched medical marijuana sales. Furthermore, two dozen states and the District of Columbia have approved the consumption of cannabis for recreational purposes. However, the sale of medical and recreational cannabis products remains prohibited under federal law.

Marijuana may remain illegal at the federal level, but progress has been made regarding cannabis policy throughout the last year. Most notably, the Department of Justice (DOJ) formally proposed reclassifying marijuana as a Schedule III under the Controlled Substance Acts (CSA) after spending years as a Schedule I substance. Additionally, presidential candidates representing both major parties supported efforts to ratify marijuana use at the federal level and end the criminalization of cannabis during the most recent election cycle.

“I just think we have come to a point where we have to understand that we need to legalize it,” said Vice President Kamala Harris.

“As I have previously stated, I believe it is time to end needless arrests and incarcerations of adults for small amounts of marijuana for personal use,” wrote President-Elect Donald Trump.

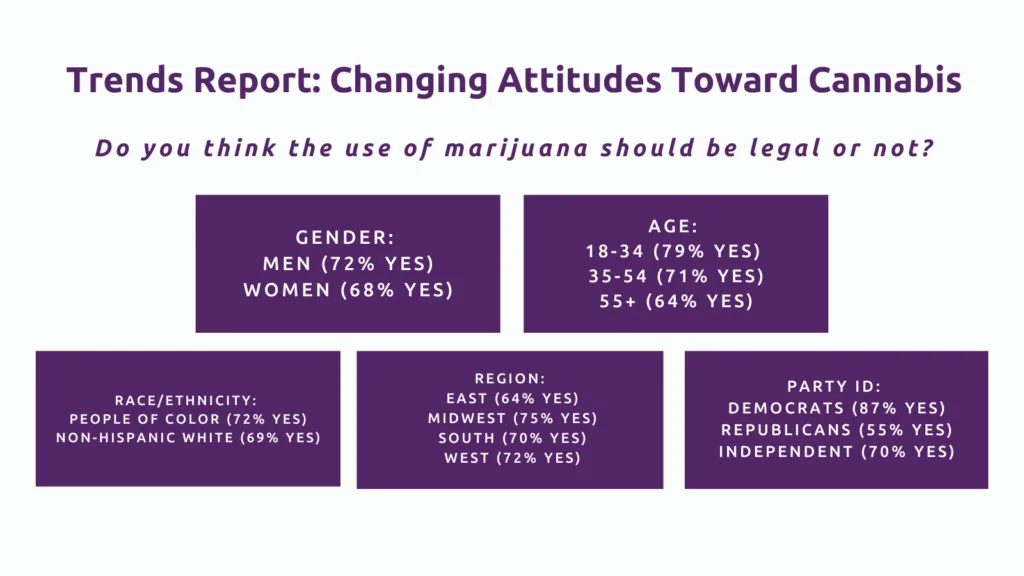

Public Perception: Cannabis Earns the People’s Vote

Much like its political leadership, the public has become increasingly accepting of medical and adult use cannabis. Seventy percent of Americans reportedly supported cannabis legalization in 2024, which had remained at 68% since 2021. Furthermore, efforts to end cannabis prohibition have become a unifying force, crossing gender, age, and political borders.

Trends Report: Changing Attitudes Toward Cannabis

Do you think the use of marijuana should be legal or not?

- Gender: Men (72% — Yes), Women (68% — Yes)

- Age: 18-34 (79% — Yes), 35-54 (71% —Yest), 55+ (64% — Yes)

- Region: East (64% — Yes), Midwest (75% — Yes), South (70% — Yes), West (72% — Yes)

- Race/Ethnicity: People of Color (72% — Yes), Non-Hispanic White (69% — Yes)

- Party ID: Democrats (87% — Yes), Independent (70% — Yes), Republicans (55% — Yes)

Changing attitudes toward cannabis have also opened the door for increased marijuana consumption. In 2013, only 7% of adults reportedly used cannabis. Eleven years later, usage has more than doubled to 15% nationwide, and nearly 10% of adults consume cannabis at least ten times per month. Taking it a step further, almost 70% of adults between 18 and 24 prefer cannabis to alcohol, and three million more adults have chosen to consume cannabis regularly than alcohol.

As cannabis consumption has become increasingly common among adults, the industry has seen significant growth among two previously underrepresented demographics — women and adults over 50. Across all age demographics, men over 21 are 6% more likely to consume cannabis than women, but women aged 19 to 30 surpassed men of the same age in cannabis consumption for the first time in 2023. Moreover, one in three women over 21 consume cannabis. Similarly, the Silent Generation and Baby Boomers have upped their consumption. More than 50% of adults between 60 and 64 reportedly consume cannabis, and cannabis use among adults 65 and older tripled from 11% to 32% from 2009 to 2019.

Business Is Business: An Overview of the Expanding Cannabis Market

The political and public acceptance of cannabis, hemp, and CBD products has generated positive returns for the cannabis business. Most notably, driving or walking past a dispensary in the United States is no longer uncommon. A February 2024 Gallup report shows there are 15,000 legal retail cannabis storefronts nationwide, and 79% of Americans live in a county with at least one dispensary.

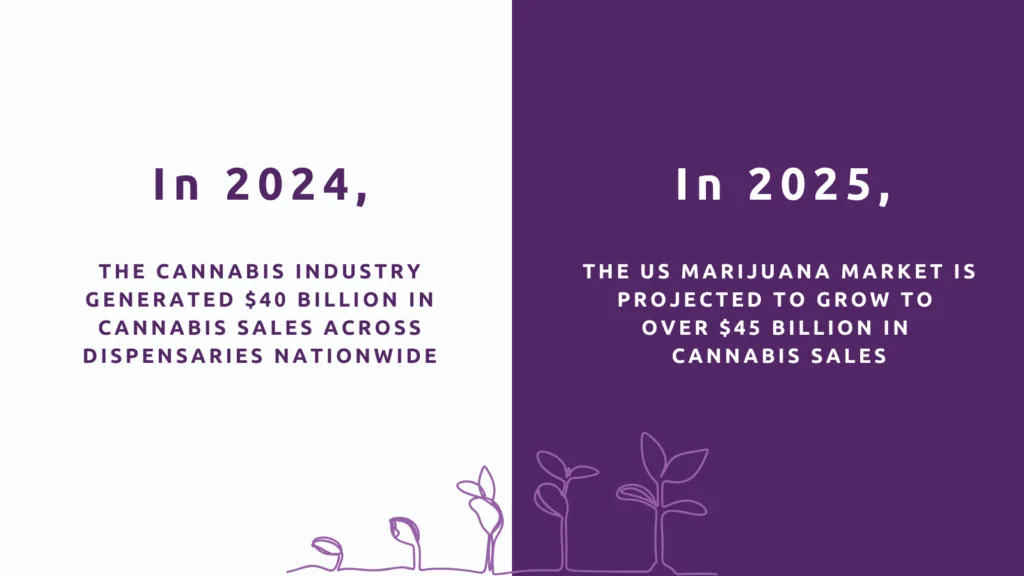

At dispensaries nationwide, products for both recreational use and medical use are flying off the shelves, generating nearly $40 billion in cannabis sales in 2024. By year’s end, eleven states saw their market size exceed $1 billion. Next year, the US marijuana market is projected to grow to $45.35 billion, according to a Statista Market Forecast. More specifically, the recreational market is projected to hit $26.82 billion, and the medical market is expected to reach $14.97 billion.

Key Market Trends: Products Driving Retail Adult Use and Medical Sales

As cannabis sales have risen and retail locations continue to open, consumers have explored the sea of expansive CBD, Hemp-derived and THC-infused products offered by the nation’s top legal cannabis businesses, including premium flower, pre-rolls, beverages, and edibles. Flower sits atop the charts in regard to market share by product category. According to a December 2024 article from Business of Cannabis, flower was responsible for 40% of retail sales, followed by cartridges (22%), edibles (14%), pre-rolls (13%), and concentrates (12%).

Pre-rolls have also shot up the charts recently, jumping 271% from $71.4 million in January 2020 to $265 million in July 2024. Similarly, edible sales have grown roughly 20% year-over-year in four of the last five years, generating $2.2 billion in sales in 2023. To a lesser degree, the infused beverage category has recorded rising sales data. Beverage sales increased 8% to $54 million between the second quarter of 2023 and the second quarter of 2024.

Beyond Cannabis Retail: How the Cannabis Industry Impacts Labor

While the industry is experiencing significant growth and evolution, cannabis companies have dealt with a mixed bag of results.

On a positive note, the legal market supported 440,445 full-time equivalent jobs last year, a 5.4% year-over-year increase. Michigan and Missouri each created more than 10,000 jobs as they expanded their adult-use markets.

Conversely, it appears fewer businesses are receiving licenses. In the third quarter of 2024, there were roughly 38,600 licensed marijuana businesses nationwide, a 1% decrease from the previous quarter. Furthermore, the number of approved and pending licenses, often used as an indicator of future growth, also dropped by 4% during the third quarter of 2024.

Of the 38,600 licensed businesses, many are having trouble turning a profit. Approximately 32% of businesses fail to turn a profit. Unfortunately, companies across several states and markets continuously run into similar issues, including nonpayment, high turnover, and failure to adhere to regulations and compliance standards. Delinquent payments in the regulated American cannabis industry rose above $3 billion in 2024, turnover rates have risen as high as 55%, and the state of Michigan fined nearly 70 businesses for regulatory violations in November 2024 alone.

Tech in the Legal Cannabis Industry: How US Cannabis Companies are Leveraging Tailored Solutions

Approximately one-third of the industry’s participants are struggling to remain afloat financially, but many are finding success in part thanks to the recent explosion of tech solutions tailored to better serve the industry. According to Grand View Research, the North America cannabis technology market size was estimated at $12.70 billion in 2023 and is expected to grow at a CAGR of 28.3% from 2024 to 2030.

At the intersection of marijuana and tech, several companies are leading the way, including Würk, Headset, Vangst, and AgEye Technologies among many others.

Würk and its peers have also had a major hand in creating positive outcomes for businesses aiming for success in the medicinal cannabis and recreational cannabis markets. From enhanced payroll management that eliminates delinquent payments to responsible compliance monitoring that helps limit costly fines, the one-stop shop for human capital management software uplifts companies and helps them reap the rewards of cannabis market growth.

Headset and Vangst leverage their expertise in tech and data analysis to examine key market trends regarding changing consumer preferences, hiring trends, fluctuation of competitor retail prices, salary shifts and much more. Meanwhile, companies like AgEye Technologies and 22Red are using machine learning and artificial intelligence to optimize cannabis cultivation and manufacturing operations.

CBD, Cannabis, Industrial Hemp & Everything In Between: 2025 Industry Forecast

Go Global: U.S. lawmakers have accepted the benefits of the cannabis plant long before many other nations and as a result, the cannabis market size is largely driven by the health of the American industry. However, that could change in the years to come. In 2024, the global market flourished. Within the last year, Germany has legalized adult use marijuana, Ukraine formally welcomed medicinal marijuana and Poland inched closer to decriminalizing the plant. In 2025, the global cannabis market will come further into focus as stakeholders in Thailand continue to work towards a more regulated marketplace and Japan launches medical sales.

Sales: The U.S. cannabis sector continues to lead the way for the global cannabis market. The worldwide cannabis market is projected to hit nearly $64 billion in 2024, with the U.S. expected to generate the highest revenue. According to projections, the United States is expected to cement its place as the home of the largest cannabis market worth nearly $60 billion in 2028.

Job Creation: States legalizing medical and recreational use not only generate revenue for industry leaders and businesses, but also create jobs. States like New York, Maryland, New Jersey and Minnesota have all created more than 3,000 jobs through the expansion of their respective markets. In 2025, Pennsylvania is projected to add as many as 45,000 jobs and Hawaii has the potential to create another 3,375 jobs if the state becomes a hybrid market.

Blog Categories

Stay Connected

Sign up for emails to hear about promotions!

"*" indicates required fields