When you need to enter an employee’s W4 form manually (from a paper printout) follow the steps below.

We recommend that whenever possible, you have your employees complete this form electronically within Wurk to streamline data entry. This method is typically built into your Employee Onboarding Checklist so that the employee is automatically prompted to fill out the W4 form as part of the hiring process. If your checklist does not include this form, then the employee will have to complete a paper form and deliver it to you by hand or as a PDF. These forms are available here.

START HERE

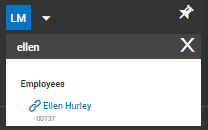

1. Navigate to the information record for the employee (under Team>MyTeam>Employe Information).

To quickly navigate to an employee record, you can search for them by name in the Search field at the top of the main menu.

2. On the Employee Payroll tab, scroll to the Tax Information area.

3. Set FORM 2020 W4 to Yes.

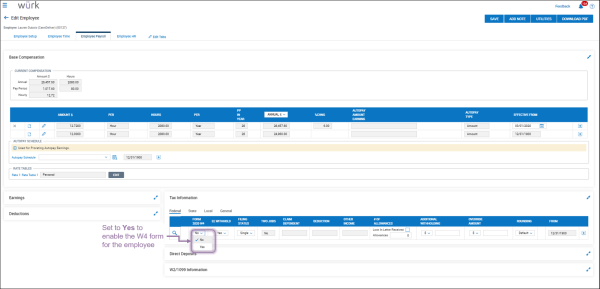

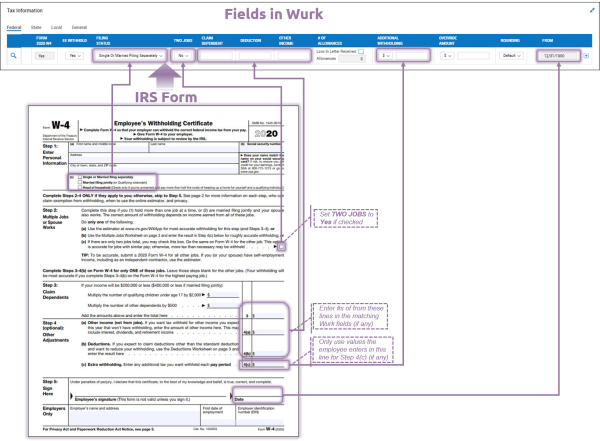

4. Copy information from the form the employee gave you to the fields in Wurk following the guide below.

| Field (in Wurk) matches… | Area on Printed Form |

|---|---|

| FILING STATUS | Step 1 c) |

| TWO JOBS | Step 2 |

| CLAIMED DEPENDENTS | Step 3 |

| OTHER INCOME | Step 4a |

| DEDUCTION | Step 4b |

| ADDITIONAL WITHHOLDING | Step 4c |

The OVERRIDE field will completely override the deductions set in the W4 form. For example, if you set it to 1000, it will deduct 1000 instead of the amounts from the form. We recommend that you do not use this field and if so consult first with your tax advisor.

5. SAVE your entries.

NOTE: If the state where the employee works requires a State W4, and the employee has provided this form, you can enter this information from the State tab at the top of the Tax Information area.