These instructions guide you in the basic steps in Wurk for hiring (or rehiring) a new employee (regular, hourly, or contractor), on systems upgraded the latest Wurk release.

For industry guidance in hiring workers for your company, watch this video.

If you are transferring an employee from another Employer ID Number ( i.e. another of your companies or company names) who is already in the Wurk system, you simply need to transfer their EIN.

If your company has enabled the Hire Employee HR Action, we recommend that you use this method instead.

Menu items and on-screen options may vary depending on your configuration and Security Profile.

START HERE

1. From the left menu panel, click Team>Employee Information. Click HIRE for a brand new employee, or locate a terminated (inactive) employee and click REHIRE (for previous employees you want to hire again).

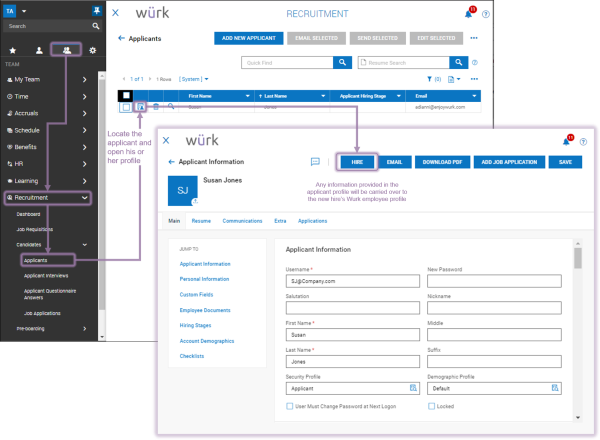

2. OR if the hire is a job candidate in Wurk (your company has the Recruitment module enabled), you can find the candidate under Team>Recruitment>Applicants and then click HIRE.

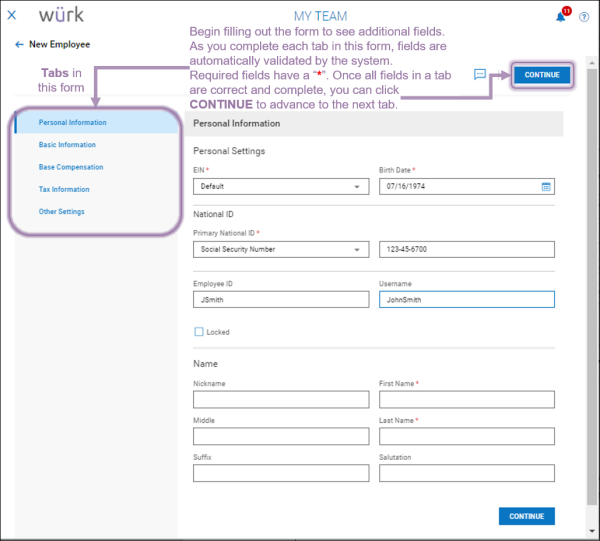

3. A tabbed form presents where you enter the new employee’s information. If the employee is a rehire or applicant in the Recruitment module, any applicable information from their existing profile is carried over.

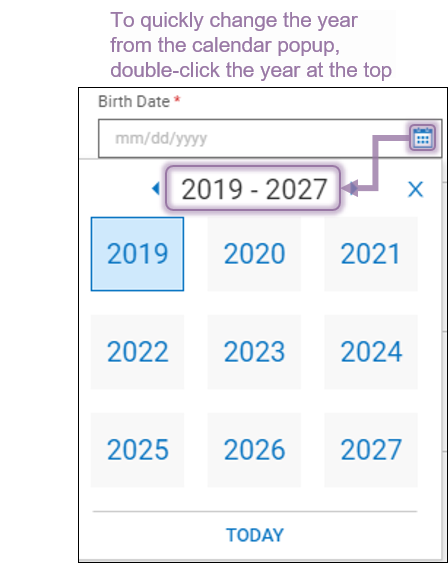

When setting dates such as the employee’s birthdate on the Basic Information tab, you can quickly change the year by double-clicking on the header at the top of the popup.

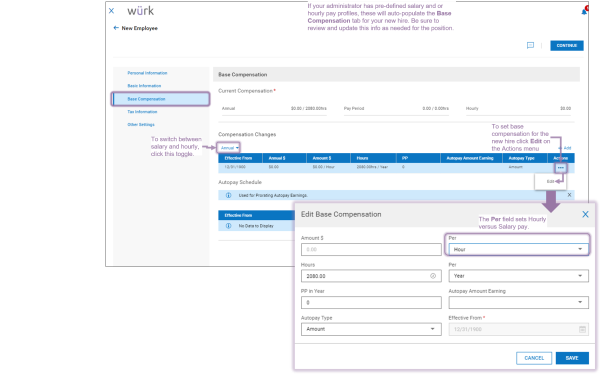

4. On the Base Compensation tab, set the employee’s pay and hourly versus salary status.

5. Once you set the new hire’s pay, job title, and so on, SAVE to return to the new hire process. You can edit these settings later.

6. On the Other Settings tab, you can specify if the new hire is a contractor or regular employee, state tax settings, and default cost center or department. If the employee is a Contractor, select Contractor >Employee Type.

7. When all entries are complete, click ADD EMPLOYEE and follow the prompts to confirm your new hire and finalize the process.

You can double-check your new hire entry under Team>Employee Information after saving.

Once you have hired the employee, you or your administrator may need to take additional steps to enable them to access Wurk. You may also need to prompt them to complete an Onboarding Checklist (where they add required employment and paperwork, such as employment verification documents/I9s, state tax forms, W4, W2 or 1099., etc.). To check on the status of that checklist and to help update it, see Working With Employee Checklists. We recommend that you walk the new hire through the basics and getting started, such as logging onto the system, using it to punch in and out, and so on, and explain to them what it is for.

Common Misclassifications of Employees

A common misclassification is when an employee is incorrectly classified as salaried, exempt instead of hourly, non-exempt. For example, an operator wanted to pay budtenders a salary as they did not want to deal with calculating and paying overtime. They did not understand that there are federal regulations when it comes to classifying a worker as exempt from overtime. Always refer to the duties test provided by the Department of Labor to help ensure you properly classify your workforce.

It is also important to ensure that you are paying your salaried, exempt workers at least the minimum salary threshold, which is currently $35,568 annually under Federal law. Some states have begun enacting their own minimum salary thresholds as well. When determining whether an employee qualifies for hourly or salary, make sure you are in compliance with the Fair Labor Standards Act.

Additionally, be careful not to misclassify an employee as 1099. Oftentimes, we see employers misuse the 1099 (independent contractor) classification. For example, a client wanted to change an employee to 1099 because the employee wanted to avoid paying taxes on a bonus. Making this kind of change to avoid tax liability, would be in violation of IRS rules around using this classification. When you think of an independent contractor, think of a worker who runs their own business, but performs work for another business. They are usually paid a flat fee for the job they were hired to complete, and the company does not have control over how the worker performs the work. The consequences for treating an employee as an independent contractor without meeting the specific criteria could result in back taxes, fines, and penalties.

Lastly, for out-of-state employees, for the EIN they work under, you must have a registered tax ID in the state where they work.